A Looming Global Debt Crisis?

with

Dr. Jerry O’Driscoll

Summary of the Presentation….

CATO Institute Senior Fellow and former Vice President at the Dallas Federal Reserve Bank, Jerry O’Driscoll, addressed the creeping crisis of rapidly rising government debt at all levels, and in many countries. Jerry surveyed the growing debt that has observers of many industrialized countries deeply concerned.

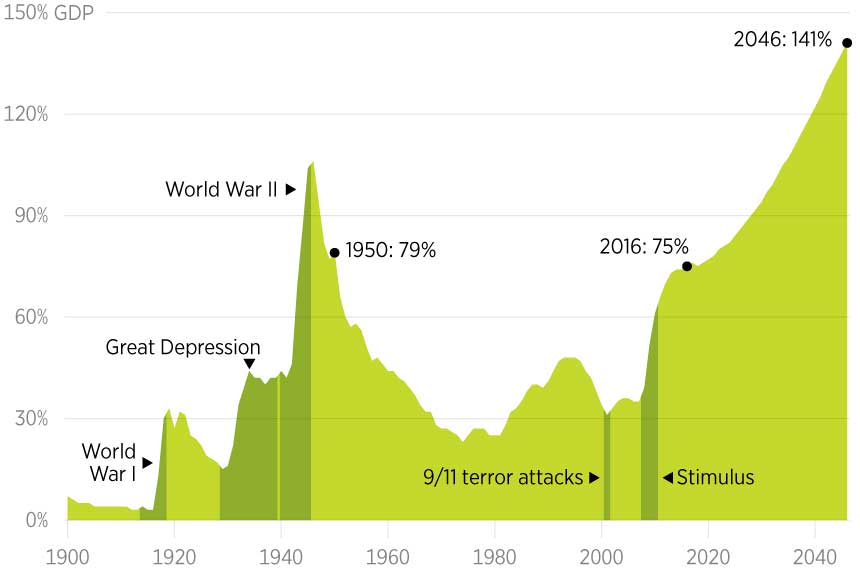

In the United States, federal debt is at a 66-year high as a share of the economy. It is forecast to continue growing. Though varying by state, most have worrisome debt levels. This is especially true when one factors in unfunded pension obligations.

Dr. O’Driscoll stressed that as the burden of debt grows at all levels of government, more resources must be devoted to just servicing that debt. That leaves fewer resources for investments that enhance productivity and stimulate economic growth.

In his presentation, Jerry included a number of graphs that starkly illustrated the rising challenge represented by soaring public debt. It is so bad that the debt burden will at least partially offset any estate a person may be planning on leaving. The soaring public debt at all levels also imposes a serious, rising burden on younger Americans.

In the Q&A period, O’Driscoll was asked to differentiate between debt held at the national, state, and local government entities. Only the federal government has the option to print more money, which the United States and most other countries have been doing for some time. This practice has not lead to a commensurate rise in lending, but has created a risk of inflation.

As O’Driscoll pointed out, politicians can’t agree on what steps to take to address the crisis. Thus, entitlement programs, compensation for government employees, and, especially, rapidly rising healthcare costs are leading U.S. government entities to the verge of insolvency. However, O’Driscoll reluctantly concluded that until a real crisis occurs; e.g. the collapse of a major city or state, it is unlikely that anything will be done.

Local and state governments need to take the first step of a “12-step program” and admit they have a problem. Until they do, not much will change.

A number of questions related to China, which on the one hand is a major holder of US. debt and on the other itself is increasingly assuming a greater debt burden. O’Driscoll noted that as the Chinese economy slows, leaders have resorted to the “tried and true” method of simply issuing more debt and printing more money. It is becoming more difficult to maintain economic growth with these strategies. O’Driscoll was also asked if China used debt as a weapon. “Yes”, he replied, but noted that on the other hand the United States in a way has “China over a barrel” because China owns so much of our debt!

Dr. O’Driscoll was asked if he were Trump’s economic czar, what would he recommend doing to reign in the national debt. The first step he said would be to mandate a balanced budget! And in doing so he said this meant reigning in spending on the major outflow categories– healthcare, defense, and social security. He recommended attendees look at the CATO Institute website titled, Downsizing Government (here is the link: www.downsizinggovernment.org).Â

Surveying the international scene, O’Driscoll said several countries were on the verge of serious financial crisis, including Venezuela and Italy. Venezuela is closer to a debt crisis, but Italy is by far the larger economy. Should these economies be unable to service their debts, there could be a ripple effect that will negatively impact the global economic order.

Attendees agreed that Dr. O’Driscoll’s presentation was informative and enlightening, but it was anything but upbeat! His PowerPoint slides are attached.

Dr. Tyrus W. Cobb

Looming debt crisis slides