Summary of the Forum on a Global Economic Crisis

The National Security Forum was treated to a particularly incisive discussion on the possibility of a “global economic crisis” with Dr. Jerry O’Driscoll. The presentation ranged from concerns over the slowdown in China’s economic growth and currency downgrade to Eurozone woes magnified by the refugee crisis to lost revenues by major oil exporting states. O’Driscoll, former Vice President of the Federal Reserve in Dallas and currently a Senior Fellow at the CATO Institute, noted that the focus of the discussion has shifted significantly from when Ty and Jerry first discussed the program two months ago.

At that time the top concern seemed to be the “Grexit”, the possibility of Greece’s exit from the Eurozone. Since then, the global economy has been rocked by deepening concern over China’s economic growth and from the impact of lost revenues from oil exporting states that depend substantially on those earnings to prop up their economies.

Turning first to China, O’Driscoll said that Beijing is at a major turning point. What is needed is fundamental economic reform, but that transformation must take place in a political system that cannot accommodate the badly needed market reforms. To paraphrase Karl Marx, China’s political system suffers from “an internal contradiction.” The country’s other problems are subordinate to this major challenge– can the ruling Communist Party in China adapt and adopt political reforms, principally toward decentralization of power, and allow market forces to work?

In O’Driscoll’s mind, the official statements from China that their GDP growth will slip from 7.3% to 7.1% is suspect. Citing a lack of transparency, Jerry said he simply distrusts Chinese economic data. He believes that Beijing’s economy may only growing at 2% a year! If this is the case– a slower growing China– that will have major repercussions on other economies, including the U.S.

O’Driscoll noted that the European Union faces a number of crises, of which slow economic growth is only one. The Eurozone continues to attempt various measures to keep Greece within the Union, but he predicts that no Greek government will be able to accept the draconian economic austerity that would be necessary to reform Greece’s economy. He also noted that other countries in the Eurozone are facing modest, if any, GDP increases over the next few years. On top of that, the EU is now faced with a crisis of hundreds of thousands of refugees fleeing conflicts in the Middle East. Absorbing or dealing with the mass of refugees is a new challenge that dwarfs the significance of the possibility of Grexit. Finally, O’Driscoll noted that the EU faces a real possibility of a major country exit from the Eurozone, that being a “Brexit”– the potential of Great Britain leaving the EU (a possibility that is growing in popularity in England).

Now to the main question: is there a global economic crisis on the horizon?

Jerry cited China’s slowing growth (that may even have stopped); signs of a further slowdown in Europe magnified by the refugee crisis; Canada now in recession; Mexico’s modest growth rate; and Russia and Venezuela dragged down into severe economic turmoil driven by the loss of revenues from exports of oil and gas.

The lone exception to this worrisome global economic summary is the American economy, which grew at an impressive 3.7% rate in the second quarter. Unemployment is down to 5.1%, and the nation is moving closer to energy independence. So long as the U.S. continues to grow, there will be no truly global economic crisis.

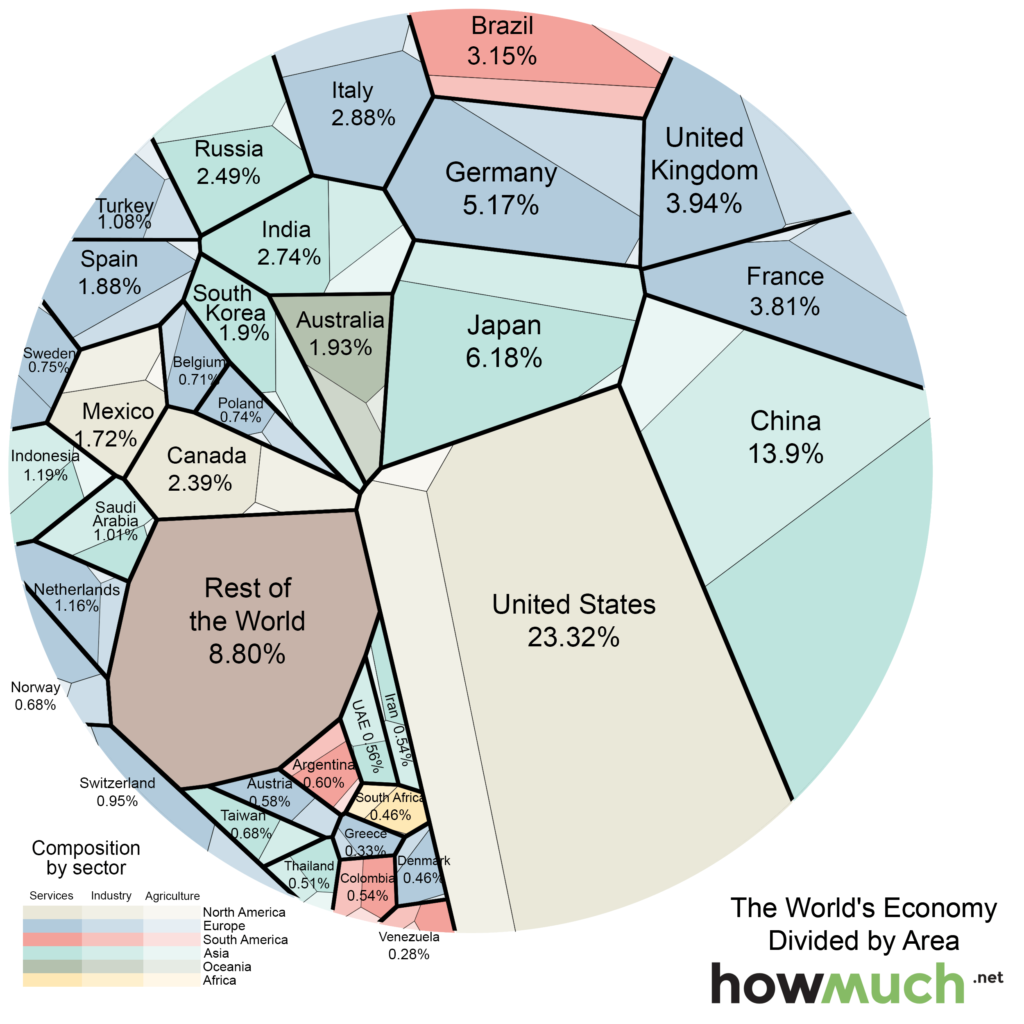

Jerry thought the graph below showing the distribution of global economic strength would be useful to take a close look at.